With the introduction of Machine Learning, Deep Learning and now Generative Artificial Intelligence. The banking sector and its billions of customers are set to benefits from improved banking services, better, personalized products, services and overall better consumer experience while dealing with banks. Bank will be able to reduce financial fraud by utilizing advance risk management and improve their reach to deserving consumers.

Benefits to Banks

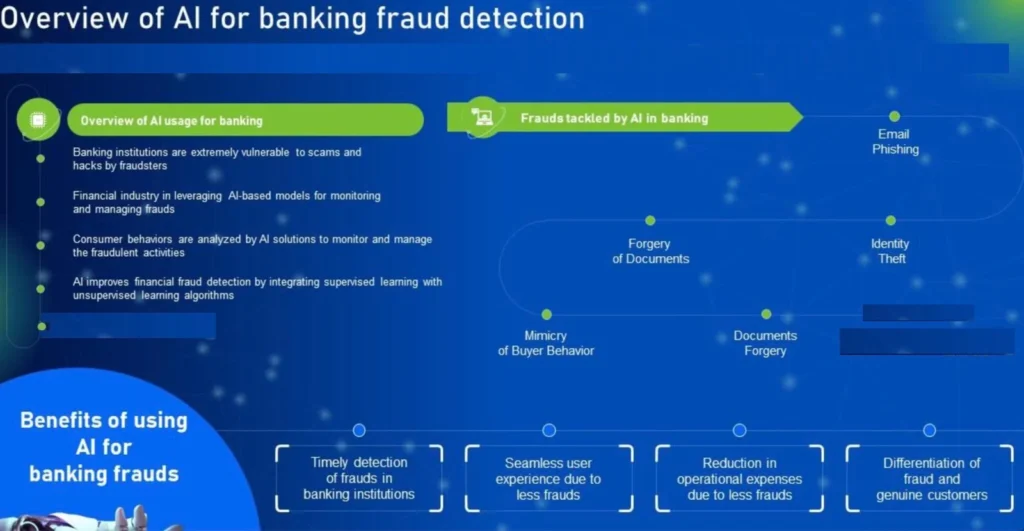

- Enhanced Risk Management: AI algorithms can swiftly analyze vast amounts of data to detect patterns and anomalies, thereby improving risk assessment and management processes. This capability helps financial institutions in making more informed decisions and mitigating potential risks effectively.

- Efficient Fraud Detection: AI-powered systems can detect fraudulent activities in real-time by analyzing transactional patterns, customer behavior, and other relevant data points. By swiftly identifying suspicious activities, financial institutions can prevent financial losses and safeguard their customers’ assets.

- Personalized Customer Experiences: Through advanced data analytics and machine learning algorithms, AI enables financial institutions to deliver highly personalized services and recommendations to their customers. From tailored investment advice to customized product offerings, AI enhances customer engagement and satisfaction.

- Automation of Repetitive Tasks: AI technology automates routine and time-consuming tasks such as data entry, document processing, and customer inquiries handling. By freeing up human resources from these mundane activities, financial institutions can improve operational efficiency and allocate resources more effectively.

- Predictive Analytics for Investment Decisions: AI-driven predictive analytics models analyze market trends, economic indicators, and other relevant factors to forecast investment opportunities and risks accurately. This capability assists financial professionals in making data-driven investment decisions and optimizing portfolio performance.

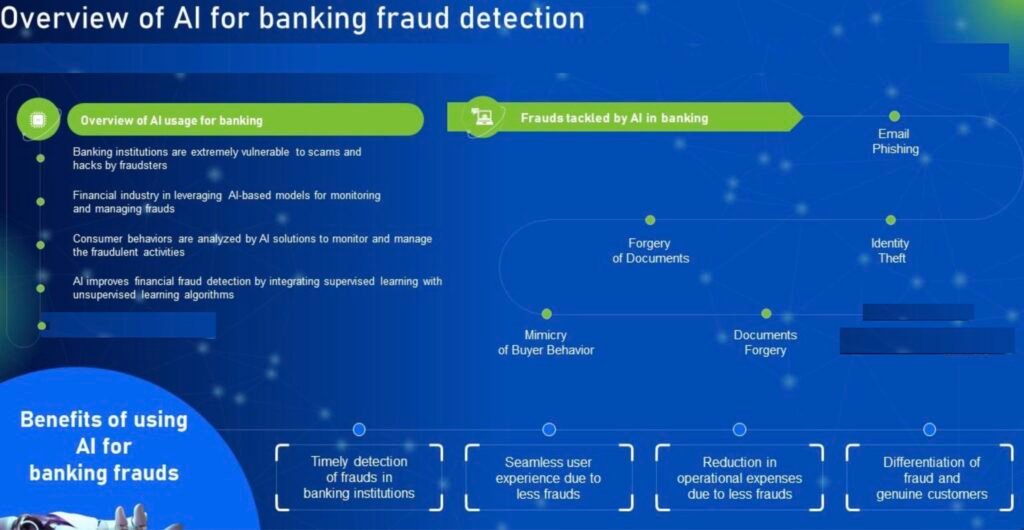

S&P Global describe benefits of AI in Banking

Benefits of AI to Consumers

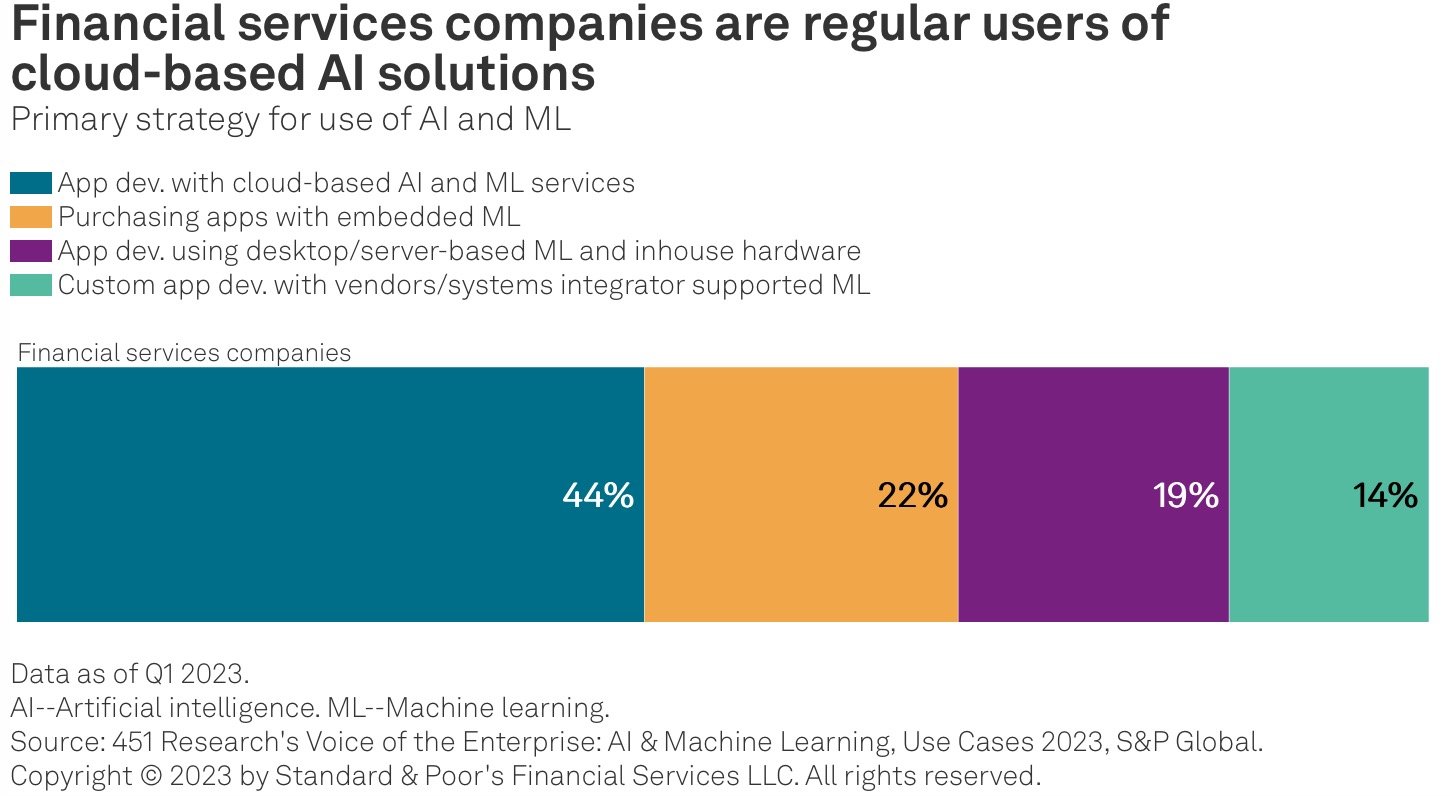

McKinsey & Company shares the benefits of AI to Banking consumers

- Personalized Financial Advice: AI-powered financial tools can provide consumers with personalized investment advice, budgeting strategies, and financial planning recommendations based on their unique goals, preferences, and risk tolerance levels.

- Faster and Smoother Transactions: AI-driven automation streamlines the process of financial transactions, leading to quicker processing times and reduced wait times for consumers. Whether it’s making payments, transferring funds, or applying for loans, AI technology enhances the overall efficiency of financial transactions.

- Improved Security Measures: AI algorithms continuously monitor and analyze consumer transactions to detect and prevent fraudulent activities in real-time. By implementing robust security measures powered by AI, financial institutions enhance the safety and security of consumers’ financial assets and sensitive information.

- Access to Innovative Financial Services: AI-driven fintech solutions offer consumers access to innovative financial services and products that are tailored to their specific needs and preferences. Whether it’s robo-advisors for investment management or AI-powered chatbots for customer support, these technologies empower consumers with convenient and efficient financial solutions.

- Enhanced Customer Support Experience: AI-powered chatbots and virtual assistants provide consumers with round-the-clock access to customer support services, addressing their inquiries and resolving issues promptly. By offering personalized and responsive customer support, financial institutions enhance the overall customer experience and satisfaction level.